When will I receive my payslip?

When will I receive a pay slip?

Paper Payslips

If you are in receipt of paper payslips, these will be sent to you in March, April, May and June of each year.

Additional payslips may be issued if there is a substantial change to your pension.

Your monthly payment will be credited to your bank on the last banking day of each month.

Monthly Online Payslips

You can now opt to receive your monthly payslip and your annual P60 online. To find out more and to register, please complete the online form. This form will require you to register with the Nottinghamshire County Council Online Services to ensure security.

Please note if you have already registered for another Nottinghamshire County Council service such as Recycling Centre Access, you will already have an account and can use those login details.

The form can be found alphabetically in the 'view all our online services' list so just look under 'P' for pensions.

We have created some general instructions which you may find useful, to get you started in accessing Nottinghamshire County Council's Online Forms

Pay dates

| Month | Year | Pension pay dates | Will I receive a paper payslip? |

Will I receive an online payslip? |

|---|---|---|---|---|

| March | 2025 | 31st March 2025 | Yes | Yes |

| April | 2025 | 30th April 2025 | Yes | Yes |

| May | 2025 | 30th May 2025 | Yes | Yes |

| June | 2025 | 30th June 2025 | Yes | Yes |

| July | 2025 | 31st July 2025 | No | Yes |

| August | 2025 | 29th August 2025 | No | Yes |

| September | 2025 | 30th September 2025 | No | Yes |

| October | 2025 | 31st October 2025 | No | Yes |

| November | 2025 | 28th November 2025 | No | Yes |

| December | 2025 | 31st December 2025 | No | Yes |

| January | 2026 | 30th January 2026 | No | Yes |

| February | 2026 | 27th February 2026 | No | Yes |

| March | 2026 | 31st March 2026 | Yes | Yes |

Understanding my pay slip

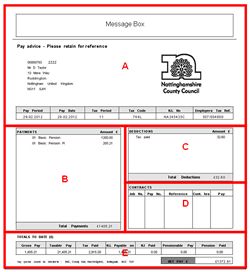

Payslips are divided into five main sections:

Section A: General information

Message Box

Any messages will be entered here.

Personnel Number

Personnel Numbers are 8 digits long and the number will be different from your old payroll number.

Pay Period

This is the current tax month; financial years start each April and end in March.

Pay Date

This is the date your pay should reach your bank; note some building societies may take longer if they use a ‘roll’ number, along with a bank sort code and account, due to their processes.

Tax Period

This is the tax month your pay has been taxed up to. See above re Pay Period, for example 01 is April.

Tax Code

This code allows us to work out how much you are allowed to earn before you pay tax.

Initially when we set up your pension payment HMRC require us to put you on 0T tax code, which means that tax will be deducted at 20%.

If you believe your tax code is wrong, you can appeal and you should contact HM Revenues and Customs (HMRC), commonly known as the ‘Tax Office’.

N.I. No

Employers Tax Reference

This is the Authority’s tax reference for all pensioners, and you should quote it on all correspondence with HMRC (Tax Office).

Section B: Payments

|

PAYMENTS |

Amounts (£) |

Comments |

|

01 Basic Pension |

1200.00 |

|

|

01 Basic Pension Pl |

205.21 |

Section C: Deductions

|

DEDUCTIONS |

Amount (£) |

Comments |

|

Tax Paid |

32.60 |

Tax As with any refunds in deductions, tax refunds have a ‘-‘ minus sign in front of the amount. |

Section D: Contracts

This will be blank

Section E: Totals to Date and Net Pay

Totals to date (£)

These are the total payments and deductions relating to your pension in the current financial year (from April to date).

Net Pay £

This is the amount you have actually been paid, after deductions, in the current pay period (your take home pay).